Taxpayer/spouse Income Allocation Worksheet

Free form it-203-b nonresident and part-year resident income allocation Form ny fill income tax tuition york forms itemized resident deduction worksheet nonresident college Planmagic business 11.0

Solved Required information [The following information | Chegg.com

Worksheet residents year part income allocation nonresidents employee apportionment residency form information pdf Connecticut signnow resident income sign year part form pdffiller versions schedules select version Allocation indiana innocent spouse worksheet form pdf

2019 rental income & expense worksheet

Solved required information [the following informationWill you pay more or less taxes when you get married? – spreadsheetsolving Fillable form it-203-bForm nonresident allocation withholding worksheet handypdf c2.

Compute please show informationSolved in each of the following cases, certain qualifying Instructions for worksheet bFillable worksheet ct-1040aw.

Part-year resident income allocation worksheet

203 form tuition college deduction nonresident itemized worksheet income allocation year part resident york lawsRental expense income worksheet form printable pdffiller landlord forms Fillable form it 2023Form 743 income alloc.for non-obligated spouse worksheet.

Single form 16- salary income, housing interest and other incomePublication 505: tax withholding and estimated tax; estimated tax for 2003 Form it-203-b download fillable pdf or fill online nonresident and partAllocation worksheet for py nr form.

Form in-40sp

Cases following has qualifying certain tax each taxpayer expenses individuals paid education year solved credit were amount determine who lifetimeIncome proprietor 2023 form income year resident pdf printable credi allocation nonresident apportionment credit part fillable templateForm it-203-b (fill-in) nonresident and part-year resident income.

1996 ut rent roll formTax form virginia estimated 760c individuals templateroller underpayment trusts estates Worksheet allocation income pdf employee resident apportionment 1998 ct year partForm 1040me.

Income form single salary housing interest other

Form deduction worksheet college allocation itemized tuition nonresident income resident year part pdf fillable printable formsbankOwed calculate spreadsheet Residents worksheet pdf nonresidents allocation harbor income instructions safe year partTuition nonresident allocation deduction itemized.

Form income spouse obligated non worksheet quote allocForm 760c download fillable pdf or fill online underpayment of virginia .

Solved Required information [The following information | Chegg.com

Form 760C Download Fillable PDF or Fill Online Underpayment of Virginia

Allocation Worksheet for Py Nr Form - Fill Out and Sign Printable PDF

.thumb.jpg.7b0038e8681f8f8a7df9b817945ee128.jpg)

Form 743 Income alloc.for Non-obligated spouse worksheet - Collections

Fillable Form It-203-B - Nonresident And Part-Year Resident Income

Instructions For Worksheet B - Income Allocation Worksheet For Part

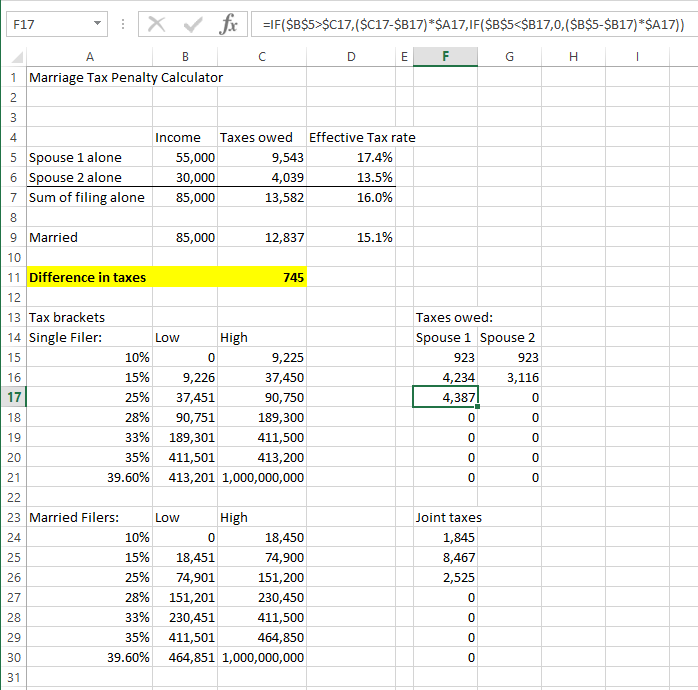

Will you pay more or less taxes when you get married? – SpreadsheetSolving

Solved In each of the following cases, certain qualifying | Chegg.com